Bitcoin Market Analysis: September 15-21

The downward pressures mentioned in last week’s analysis continue to be an issue for Bitcoin’s Price. The big announcement this week was the possible facilitation of Bitcoin transactions through PayPal or one of its subsidiaries. The affects on the price can certainly be debated, but here is another view from the Price-Confidence perspective. If we break down confidence into 3 major components:

- Miners and Core Developers/Code

- Semi-Anonymity element

- The Price itself (because at this point if price drops to $50 or below all confidence in Bitcoin might be lost)

PayPal serving as the ultimate middle man is a great Public Relations move, puts Bitcoin on front pages and possibly on the way to mass adoption and acceptance, but it also has the ability to undermine all three of the confidence levels listed above.

Buy providing Millions of merchants an immediate ability to accept Bitcoins, the exchanges might have a large supply of Bitcoins in need of liquidation and at the moment the demand to acquire Bitcoins is not growing at the same rate as places to spend them. This has a chance to put a significant pressure on prices. As for the Core Code and Miners, mass adoption at this stage can be problematic so having Millions of merchants come on line and many people spending can quickly bring about issues with Bitcoin’s limit of only 7 transactions a second. Finally the confidence in Anonymity does not need much explanation. A centralized place for bitcoins to move through that has a history of freezing accounts even when not ordered to do so can’t possible be a good thing for the privacy conscious.

These are just some of the current headwinds facing Bitcoin, but as you know from 2013, things can turn on dime with the right news event.

The Month Ahead

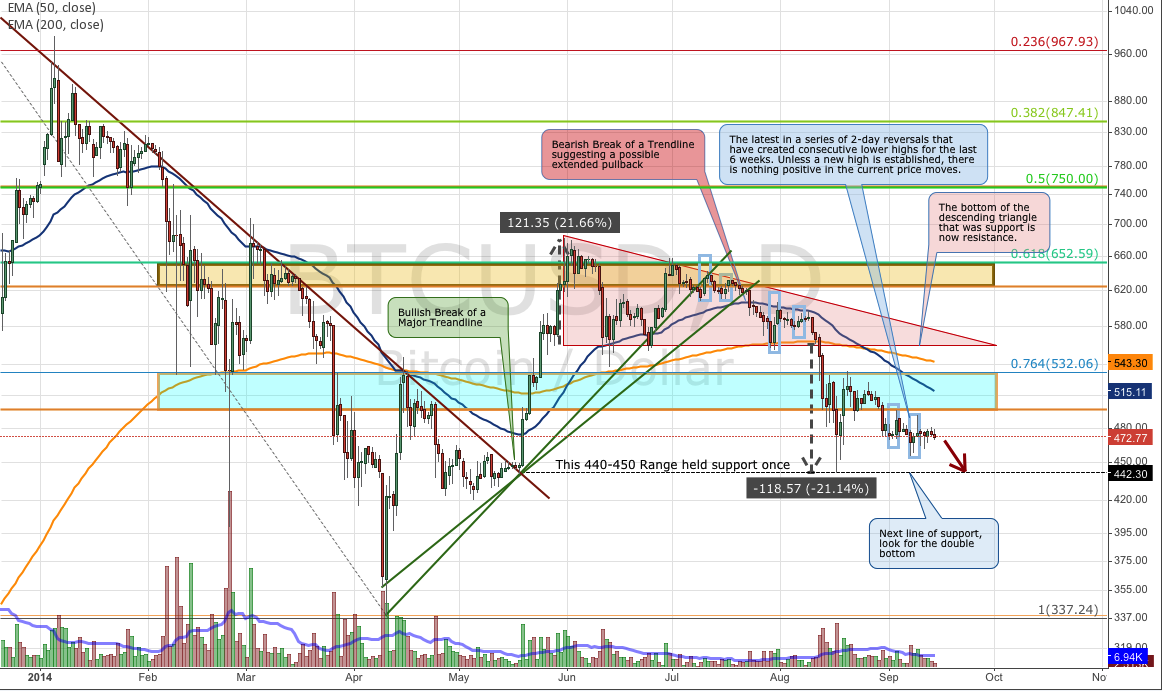

The future is still looking tough for Bitcoin, there is very little positive to point to in the charts. The price did appear to reverse last week from higher lows in the $450’s compared to August lows, but it also created a lower high in the $490’s. The price is now in the $470’s, but unless we see the cycle of lower highs, broken the trend remains bearish. There is still a lot of resistance overhead starting at the $500 mark then $530, $560 (base of the descending triangle), $630, $650 and $750. Not much at all holding the price up technically. We have the $440-450 support area and then open air down to $340-380 zone. Look for news to help reverse the downward price trend, but as it stands, expect more downside over the next month. Any signs of a swing in momentum to the bull side would start after the price can re-capture $500 and turn that mark into a support zone.

The Week Ahead

Looking at an intraday chart we can see the breakdown talked about last week was not as deep as expected and we have already rebounded nicely to form a lower high in the low $490’s. The RSI overbought/oversold circles have identified short-term reversals nicely but we are consolidating down the middle of this indicator. Watch the RSI 40 line as it may not be able to reverse for the 3rd time over the last 5 days. The MACD divergence is also pretty noticeable last week but it was not as strong as the one back in August confirmed by the RSI. Keep an eye on the $470-480 range as the price has spent the majority of the last two weeks in this range. The longer we spend around $480 the higher the chances of a breakout, but unless we see new high over $500 don’t fight the negative trend.

Conclusion

We are no closer to a reversal than we were last week. More downside is probably likely though it is not as imminent as it was last week when the Descending Triangle was clearly visible. We are still looking at $440-450 as the probable downside target and will wait until the price pushes back above $500 before focusing on potential upside.

Reference Point: Monday Sep 15 7:00 am ET, HitBTC Price $474

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences worldwide. He also runs his own personal blog called LibertyLifeTrail.