Bitcoin Market Analysis: Week November 3-9

In last week’s update, we were neutral and decided to wait and see which side would win. Looks like it was the sellers and we lost the $330-340 support level early in the week. This should now set the stage for the rest of the year as prices begin to be put more under pressure as the overhead resistance continues to build.

The big news of the week was regulation related as FinCEN put out additional guidance and rumors of SEC letter going to certain companies continue to spread. A regulation burden at this stage of the game would be a major problem for a lot of small bitcoin companies, which just like in the global economy create most jobs and spur innovation. People are starting to shy away from exchanges though the interests for Bitcoin still exists. Numerous cash buyer are out there looking to buy bitcoin in large amounts. One person can view that as going around authorities because if they had nothing to hide why would they use cash? But the counter argument would be that some would just like to keep their lives simple and not have to worry about a regulatory environment that is not even close to understanding bitcoin not to mention trying to regulate it. A recent article was also published suggesting that there is collusion among exchange since when prices on one go down they all go down. This is of course complete nonsense and perhaps there are large traders that might be following each other, what does the author of the article expect, one exchange to drop in price as the other rises?

As always there are bright sides popping up, but they are more for future bitcoin prospects and not for immediate price reversals. Bank of Japan will most likely be buying all the Government bonds since no one else will. The government might as well just print the money for themselves and save the bureaucracy and unnecessary jobs. Also more stories popping up about police in the US overstepping with civil forfeiture laws, which allow them to just take someone’s property without due process, are all signs that people are more likely to look for alternatives.

The Month Ahead

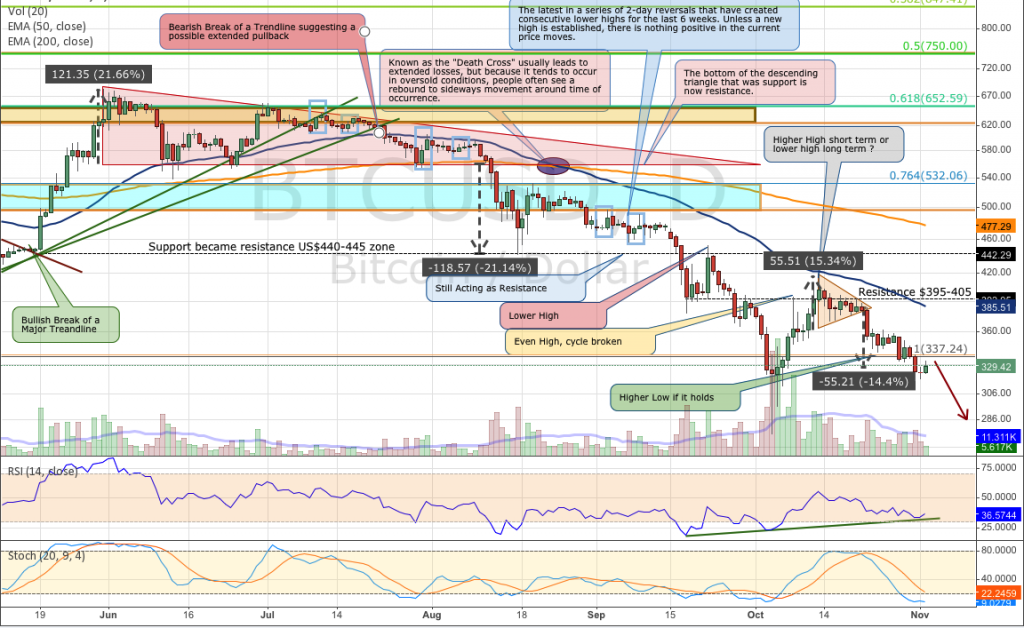

This time of year has been historically good for Bitcoin’s price but at the moment it’s not looking like it will be one of these years. When the $340 support broke down, it was a very bearish sign and will most likely lead to lower prices. We can bounce back to $340, which is now established resistance but until we can get back above $350 and most likely back over $420 everything remains a countertrend rally. At the moment we are looking for a move to $300-305 and if that can’t hold things up then keep an eye on the $265-275 zone.

he Week Ahead

The shorter-term chart is once again displaying the pattern of lower highs and lower lows. Until this pattern visibly breaks there is no reason why it can’t continue for longer than people think it should. The next Fibonacci support is at $308, which is right above the $300-305 support zone so if that area cannot hold the price up, you have to be really careful.

Conclusion

We are now pretty bearish on the market, in an environment where everything turns on a dime and we are just above yearly lows this is a difficult position to take, but we look at what the charts show us. Other than yesterdays Daily Doji candle and what is shaping up like a positive day there is not much else to go with for the bulls. There is plenty of resistance just under $340 so any move up should take a pause there and then we would most likely see lower prices. Keep an eye on the $300-308 zone for possible support and if that breaks, then it’s most likely back to yearly lows at $265-275.

Reference Point: Monday Oct 20 8:00 am ET, HitBTC Price $330

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences worldwide. He also runs his own personal blog called LibertyLifeTrail.