Bitcoin Market Analysis: September 8-14

At the moment the bitcoin price is experiencing numerous downward pressures. Companies like Overstock are trying to relieve some of this pressure by paying their employees in bitcoin and perhaps they will also be able to convince their suppliers to accept the new asset class as payment, but for now the majority of these merchants are quickly converting into local fiat on the open market. Talk is also starting to pick up in Bitcoin circles that big players might be considering taking some profits from their early entries and mining profitability is starting to get stressed at these prices. If some miners decide to shut down creating less competition in the space, it would just cause another wave of media coverage of how this ecosystem is too concentrated and can be manipulated by a few actors.

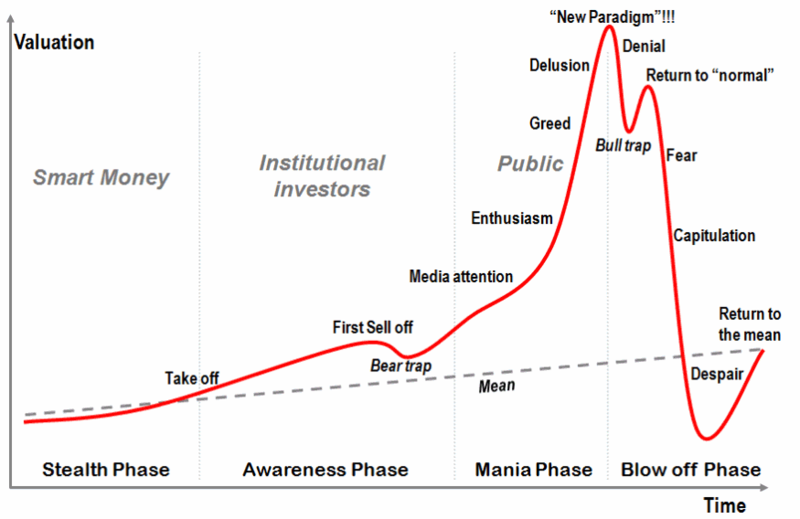

Looking strictly at the price it is starting to resemble a classic bubble aftermath with all the typical signs and if the price can’t reverse soon, the chart indicates the entrance into the “Fear” stage later this year.

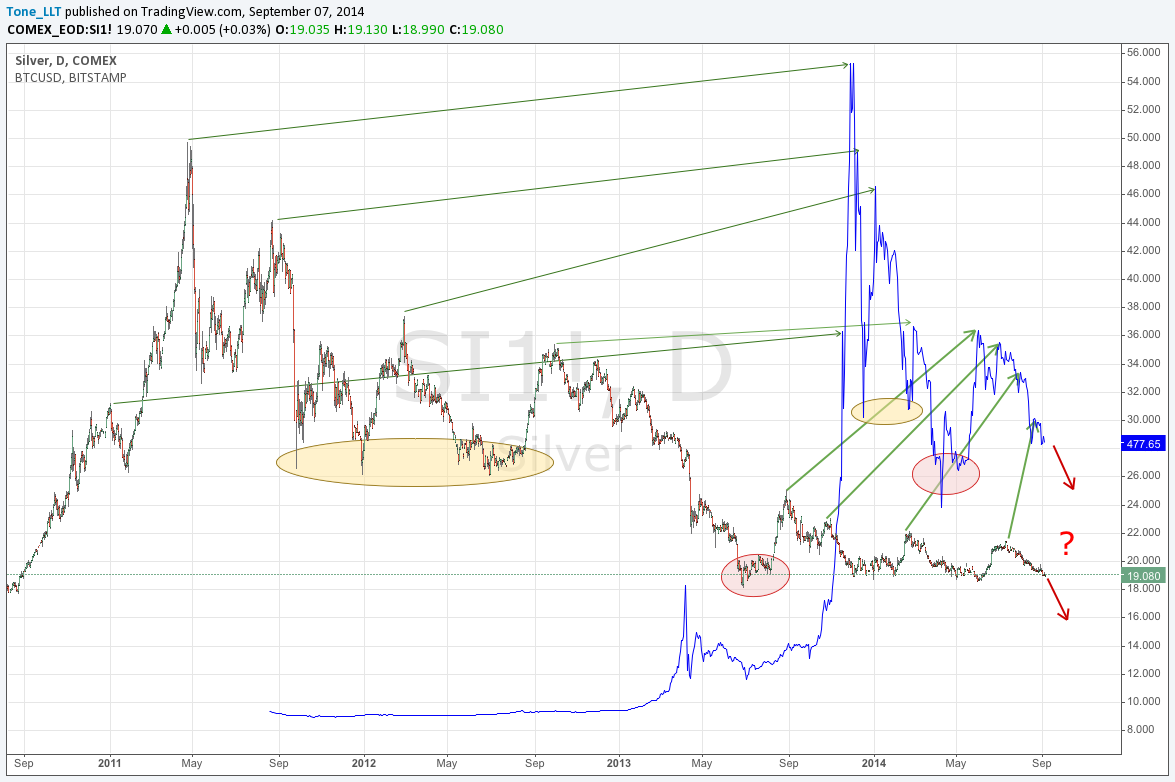

It is also following movements of what silver has done over the last 3 years to a tee just at a much faster pace as you can see in the following chart.

At this point however, it is more likely that Bitcoin will become the guide to what happens in the Precious Metals space but we are looking at a new frontier. We all know that Gold & Silver will not go to 0 and unlike what most Gold-Bugs still believe, the days of using gold to settle global transactions are long behind us. It’s just two impractical in this fast pace environment of the 21st centaury. Bitcoin however, still has potential to reach both extremes, all confidence can be lost in the blink of an eye or it can become the dominant from of global transaction settlement.

The Month Ahead

The future is looking tough for Bitcoin, not much positives to point to in the charts. A lot of resistance overhead starting at the $500 mark then $530, $560 (base of the descending triangle), $630, $650 and $750. Not much at all holding the price up technically. We have the $440-450 support area and then open air down to $340-380 zone. Look for news to help reverse the downward price trend but as it stands, expect more downside over the next month. Any signs of a swing in momentum to the bull side would start after the price can re-capture $500 and turn it back into a support zone.

The Week Ahead

Looking at an intraday chart we are sitting right underneath a descending trend line in what is looking like a short-term descending triangle in the making. There is always a possibility of a breakout to the upside, but the odds favor more downside once the $470 horizontal support is broken. Watch the next day with care to see if it can break one way or another. Both the MACD and RSI are right down the middle and we are working off the overbought condition of last week where the price rallied $30 to $500.

Conclusion

A reversal in trend cannot be anticipated, there need to be clear signs and at the moment they are few and far between. Everything points to a little more downside on the horizon but if mass adoption is to come it can change everything around very quickly. We are looking at $440-450 as a potential downside target and will wait until the price pushes back above $500 before focusing on potential upside.

Reference Point: Sunday Sep 7: 2:00 pm ET, HitBTC Price $480

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences worldwide. He also runs his own personal blog called LibertyLifeTrail.