Bitcoin Market Analysis: November 10-16

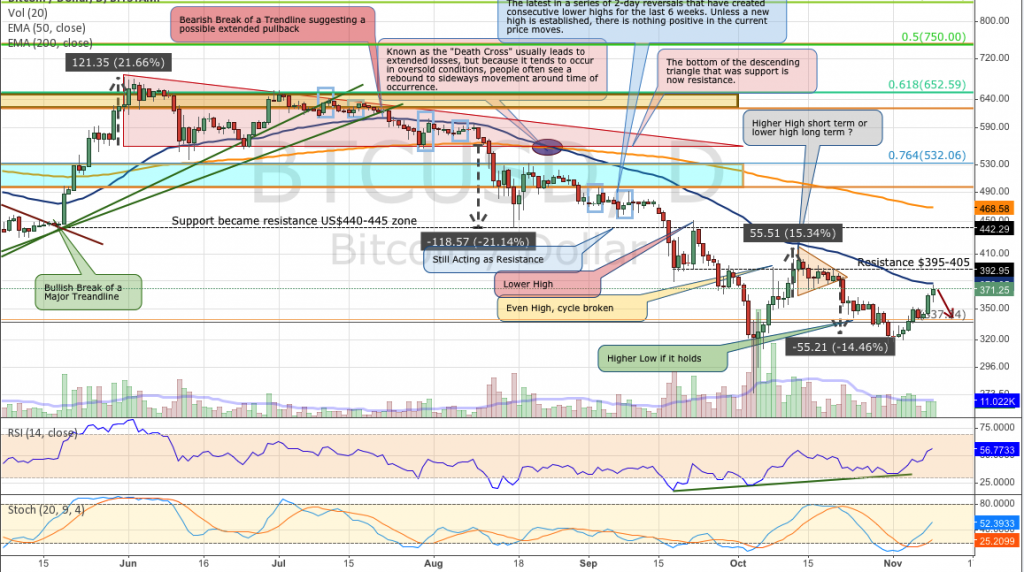

In last week’s update, we turned bearish as the price was starting turn down after what looked like a perfect technical reversal a the 50 SMA at the $330 price mark. The expectation was that prices would continue down to the $305-308 zone. That view clearly did not pan out as the price not only broke the 50 SMA on the short-term chart but also the 200 SMA a few days later. The two moving averages have now crossed signaling that we might see additional bullish momentum.

The overall picture of Bitcoin remains under some pressure. The big news this week came from the law enforcement agencies, which have shut down many Silk Road 2.0 sites. Of course Bitcoin is front and center since it’s the only currency these markets trust. Some would consider this a badge of honor and something those in power are having a hard time understanding. The reason why these markets cannot be stopped is that they provide mutually beneficial commerce and the fact that they trust bitcoin to serve as the intermediary currency speaks for itself. Silk Road 3.0 is already up and running so it look like it’s business as usual for both sides.

Another big news story was from Yahoo suggesting that with the devaluation of the Ruble, those in Russia might be looking to Bitcoin, hence a possibility of a significant rise in prices. The concept itself is very valid and if this ware the Euro or even a bank in a major European country like Spain or Italy going through a Cyprus style confiscation, Bitcoin’s prices would be making new all time highs. In the case of Russia, the situation is quite different. Because the middle class is not as developed as in the west there will not be mass Russian adoption across the country and as for the rich oligarchs, they have plenty of other options to move their money which is probably not even sitting in Ruble’s to begin with.

The Month Ahead

As difficult as it is to say and at a chance of being wrong two weeks in a row for not believing in this really, we are expecting the 50 day SMA to stop the rebound that the 50 120min SMA could not do at the beginning of last week. We will remain Bearish until charts look significantly better and it starts with crossing that moving average in the $375 area and then getting above the $400 resistance. Keep an eye on a fall back to $345 or even $330 and if those areas are lost, our new established low of $315. If the prices continue to rise and the volume picks up we would have to change our view later in the month.

The Week Ahead

The shorter term charts is now looking more promising with the cross above the 200 120min SMA we have now hit RSI overbought for the second time in one week and jumped right over a Fibonacci line at $363 last night. Ideally we would like to see a pull back right here back to the 50% Fibonacci at $345 and then probably a move higher.

Conclusion

These past few weeks have been very difficult at technically analyzing Bitcoin. The short term RSI, which has been very reliable in the past with picking tops and bottoms has been less so with multiple continues hits off oversold and overbought. At the moment the Monthly view is showing a different picture than the short-term view. Looking at the short-term view the next line of resistance is above $380, then $400, but on the daily chart we have reached the 50-day SMA, which is a big deal. Sticking to the traditional means of analyzing though knowing full well attempting to forecast Bitcoin is fools errand, we are looking for a pull back right here before evaluating if much higher prices are in coming in the near term. Remaining Bearish one more week.

Reference Point: Monday Nov 10 8:00 am ET, HitBTC Price $370

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences worldwide. He also runs his own personal blog called LibertyLifeTrail.